Charlie Martin

Paradise Divide Capital

August 3rd, 2021

Danaher (NYSE:DHR)

Disclosure: Paradise Divide Capital or “the Fund” is long Danaher. It is one of the Fund's core holdings, as it represents 4.22% of the total allocation in the Fund. Since the Fund initiated its position in Danaher, it’s share price has increased 48.25%.

Business Overview: Danaher is a diversified healthcare company operating in three segments: Life Sciences, Diagnostics, and Environmental & Applied Solutions. Operations in the Life Science include, but are not limited to: mass spectrometers, cellular analysis, lab automation, genomics consumables, and more. Operations in the Diagnostics segment include, but are not limited to: chemistry, immunoassay, microbiology, and automation systems, as well as hematology and molecular diagnostics products. Operations in the Environmental & Applied Solutions include, but are not limited to: instrumentation, consumables, software, services, and disinfection systems to analyze, treat, and manage ultra-pure, potable, industrial, waste, ground, source, and ocean water in residential, commercial, industrial, and natural resource applications.

Historical Performance: Danaher’s share price has a trailing ten year compounded annual growth rate, or (CAGR), of 20.7%. It’s trailing five year CAGR is 29.8%. Danaher issues a dividend at 0.84 per share (0.24%). It has increased its dividend every year since it started issuing a dividend. Below is Danaher’s stock chart since inception.

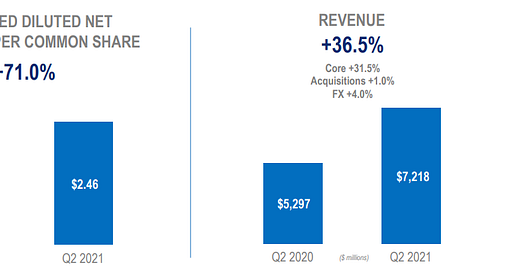

2Q Results Slides: Bottom line growth was massive for Danaher in Q2 21. EPS grew by 71% YoY. Top line growth was also extraordinary for Danaher delivering 36.5% YoY revenue growth.

This growth was driven by huge increases in revenue in all three of their business segments. In Life Sciences they grew their revenues by 41.5% YoY and operating margins grew by 15%.

The Diagnostics segment grew by 40.5% in YoY revenue and 10.1% in operating margins.

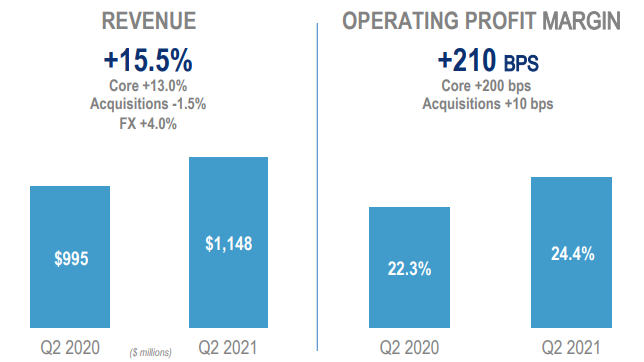

Finally, the Environmental & Applied Solutions grew 15.5% YoY in revenue and 2.1% in operating margins.

Financial Data: In fiscal year 2020, or FY20, Danaher did 22.28 billion in revenue, an increase of 24.4% YoY. On that revenue, Danaher’s gross margins were >60%, a number commonly seen in software, but not in a healthcare company. Danaher was able to deliver gross profits of 12.93 billion in FY20.

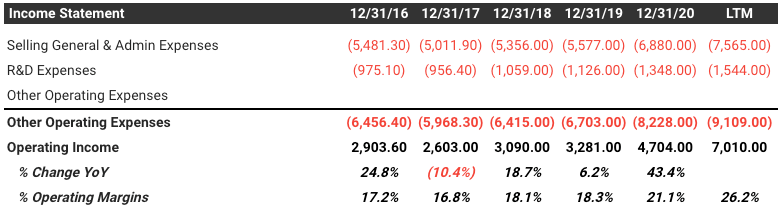

Other operating expenses, such as Selling General & Administrative expenses and Research & Development, cost Danaher 8.2 billion. That brings the net income during FY20 down to 4.70 billion.

In these numbers, a narrative persists: Danaher is able to provide superior returns on equity. Danaher has been able to increase its gross margins by 5% in the past 5 years, creating massive growth in operating income and operating margins, and subsequently creating a surplus of shareholder value.

As evidenced by the income statement, Danaher has not needed to use share buybacks to create shareholder value, but rather used the growth of its business. They are able to issue shares to raise cash, without significantly diluting previous shares. They are also able to raise cash to finance mergers and acquisitions at a low cost of capital; they raised 700m in cash with a credit spread of only 34bps when credit spreads were 215bps, proving the strength of Danaher relative to other investment grade companies and Treasury Notes.

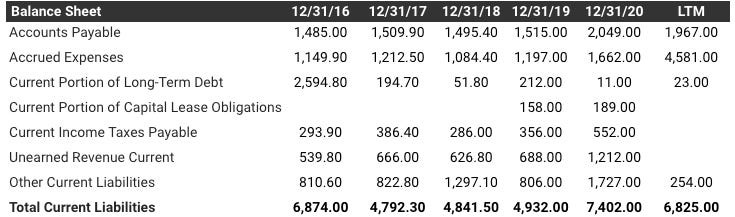

Having such low credit spreads speaks mostly to the strength of Danaher’s balance sheet and the consistency of the unlevered cash flows. Danaher has accessible cash of 7.32 billion and has current assets totaling 15.39 billion. Danaher has employed a decent amount of leverage on their balance sheet, mainly to fund acquisitions, but that debt falls in the non-current asset part of the balance sheet. Its current liabilities only total to 6.83 billion, resulting in a current asset/current liability ratio >2.5. This proves that Danaher it would be almost impossible for it to become insolvent, which is seen in their low credit spreads.

With an outstanding balance sheet and income statement, it can be predicted that the cash flow statement will reflect those amazing numbers. And that is exactly what the cash flow sheet shows. I will not go in depth on it, but I will leave it below.

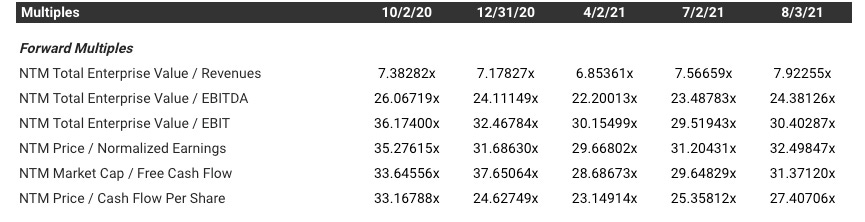

Valuation: Given all the amazing numbers spelled out above, it is no surprise that Danaher has a rich valuation, but when its growth is taken into consideration, it doesn’t seem that outrageous. It has a market capitalization of 215.8 billion and an enterprise value of 232.3 billion. That means it has a NTM Total Enterprise Value/Revenue 7.295x and an EV/EBITDA of 24.38x. It’s NTM Price/Free Cash Flow 27.4x. While those are certainly high, given the growth that Danaher is able to, it is certainly justified. Those are the forward multiples that I take into consideration, but I will leave a chart of all forward multiples below.

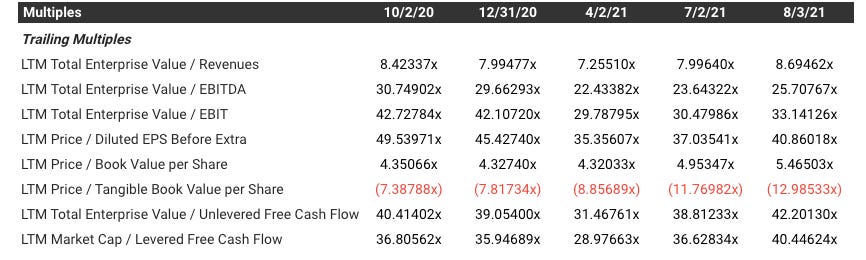

Concerning trailing multiples, I will only mention the LTM Total Enterprise Value/Unlevered Free Cash Flows of 42.2x. Again, all other trailing multiples will be shown below.

After that, I don’t think that valuation metrics matter, and if Danaher was an emerging software company, I wouldn’t even mention valuation because it doesn’t matter.

News:

I think that I should mention Danaher’s recent acquisition of biotech company Aldevron. It is an all-cash 9.6 billion dollar deal.

Conclusion:

Given all this information, there is no reason not to have extraordinarily high conviction in both Danaher as a company and a stock. We intend to hold and add to this company forever. It’s outperformance of the market has contributed significantly to the success of the Fund.

Would you recommend a levered short position at some price level?